The global pandemic has vastly changed the way we live, work, and shop since 2020.

In Southeast Asia, nationwide lockdowns, movement controls, and social-distancing measures have led to new consumer behaviours and preferences, accelerating the shift toward the digital-first experience, particularly for payments and commerce.

Visa’s Consumer Payment study provides key consumer insights based on the latest trends in payments, changing commerce moments and the consumer journey powered by technology and innovation.

In this post, we will look at a few key insights about Malaysia’s current and future payment behaviour.

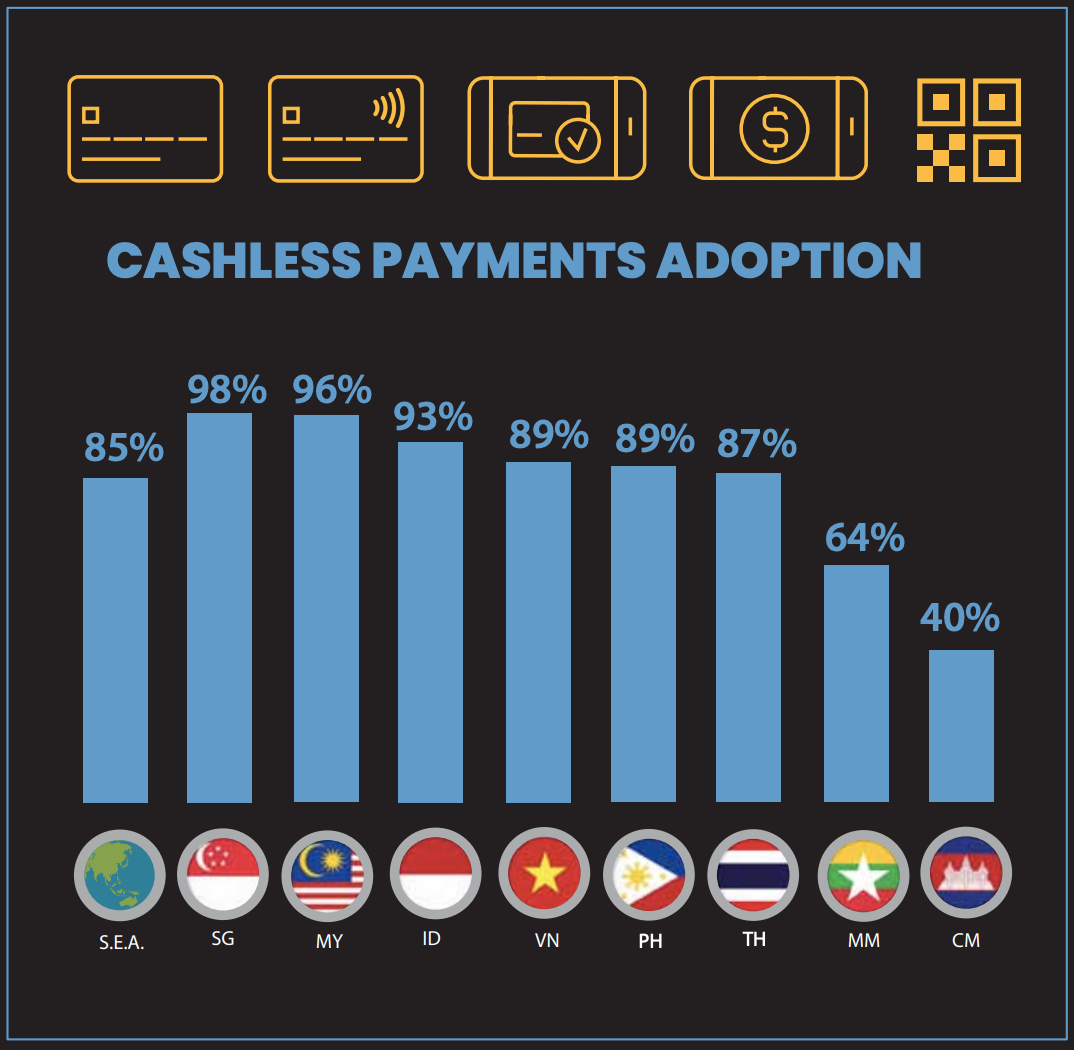

1. Cashless Payments Continue to Gain Traction in Southeast Asia

Did you know that Malaysia has one of the highest cashless-payment adoption rates in Southeast Asia?

Even in the pre-COVID era, Malaysia’s rate of cashless payments was rapidly increasing to a great extent.

If your business still doesn’t offer a cashless payment method, you should consider adopting one to stay on track.

Thanks to Malaysia’s high cashless adoption rate, we now have low cash usage (23%) among Southeast Asian countries.

While certain retail outlets and industries still depend on cash as their primary payment method, the cashless society is gaining momentum.

I still remember that a few years ago, cash on delivery (COD) was quite popular as the preferred payment method for giant marketplaces in Malaysia.

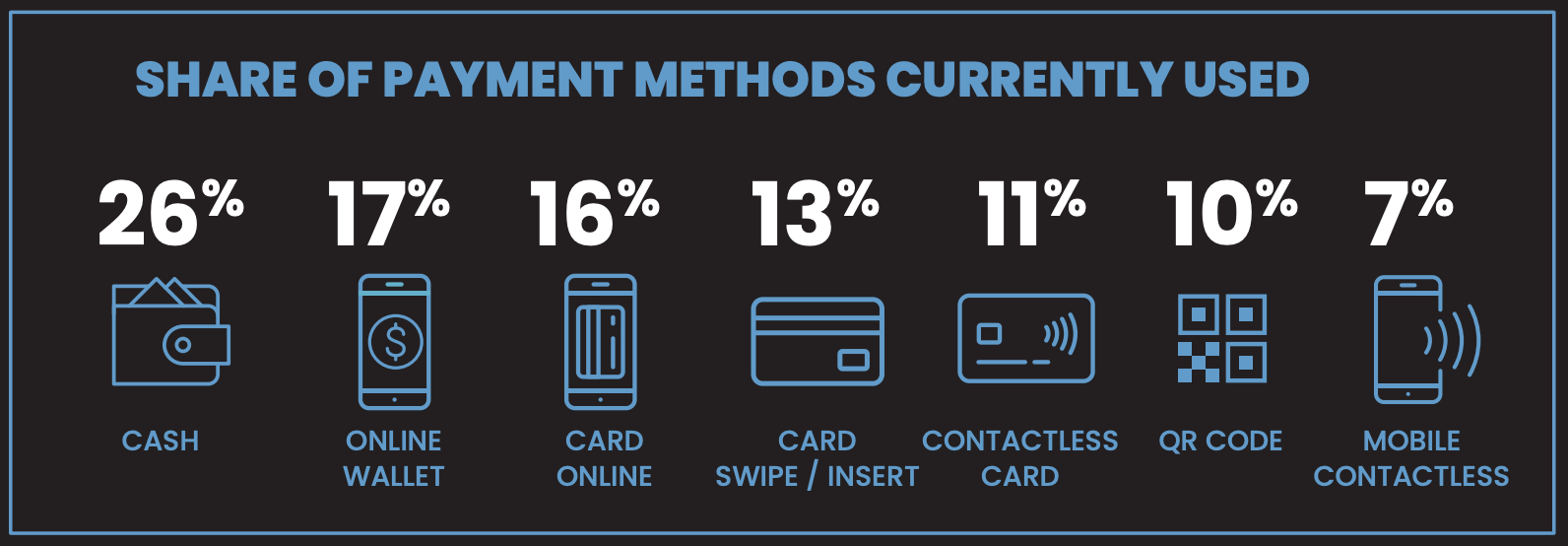

But the trend is slowly evolving to online wallets, debit or credit cards, QR codes, and mobile contactless payment methods.

Certainly, there’s a good and a bad side to offering a variety of payment methods, and there is no doubt that cash will stay for a while longer.

But the competition among cashless payment methods will continue.

For people who prefer a simple way to pay online, having too many choices may prolong the purchasing process as they figure out which payment method is best.

This situation indirectly slows down the checkout process because more research is needed before consumers can pay.

I think the “Rise of eCommerce” and “Increased Acceptance by Merchants” factors have helped increase the usage of cashless payments the most.

In fact, many consumers already expect all online merchants to offer popular payment methods such as e-wallet by default.

Ask yourself how often you withdraw cash from an ATM machine these days?

We do so less often than we used to because we are already living in a cashless society.

“Risk of Contact Infection” is also a strong motivating factor encouraging consumers to switch to totally cashless payments, especially for retail businesses.

2. COVID-19 Has Accelerated the Transition to Cashless

As the country continues living in a lockdown environment and movement orders restrict us in many ways, we have fewer opportunities to pay in cash.

Everything from groceries to food delivery and even high-value products can be easily purchased online with a few taps on a smartphone.

With the COVID-19 virus continuing to mutate and getting stronger, consumers are trying their best to lower any risk of infection, including reducing their cash usage.

Categories that are expected to go fully cashless in the future include essential areas such as bill payments (64%) and supermarket purchases (59%).

This prediction is likely due to their routine or recurring nature. All subscription-based services are using cashless payment now.

If your business can offer a popular payment method preferred by your target audience, then you can remove one more barrier stopping consumers from choosing your brand.

Many consumers will simply choose what is familiar and convenient for them.

3. Consumers Are Facing an Increasingly Fragmented Payments Landscape

With a number of digital payment methods gaining traction across Southeast Asia, consumers now have an abundance of choices.

There are more ways to transact and more places where commerce can happen than ever before.

If we look at the percentage of online wallet payment methods, we can see that Indonesia has the highest percentage, at 24%.

Singaporeans prefer using contactless cards as a payment method, with a rate of 31%.

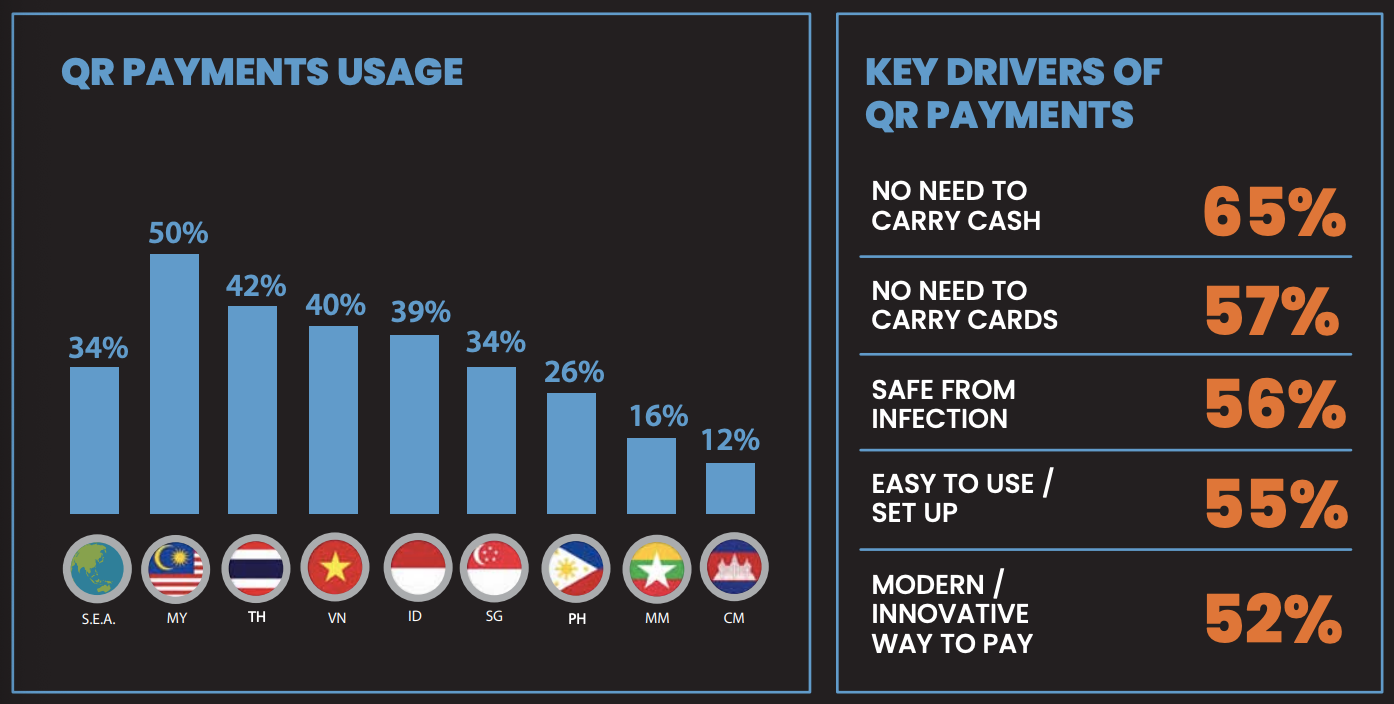

It’s no surprise that QR payment is widely used in Malaysia.

All Malaysians use the MySejahtera app, a mandatory contact-tracing app implemented by the government. Everyone living in Malaysia must scan the QR code to record the places we visit.

Singapore’s PayNow, Thailand’s PromptPay and Malaysia’s DuitNow play an important role in driving mobile contactless payments using QR payment technology.

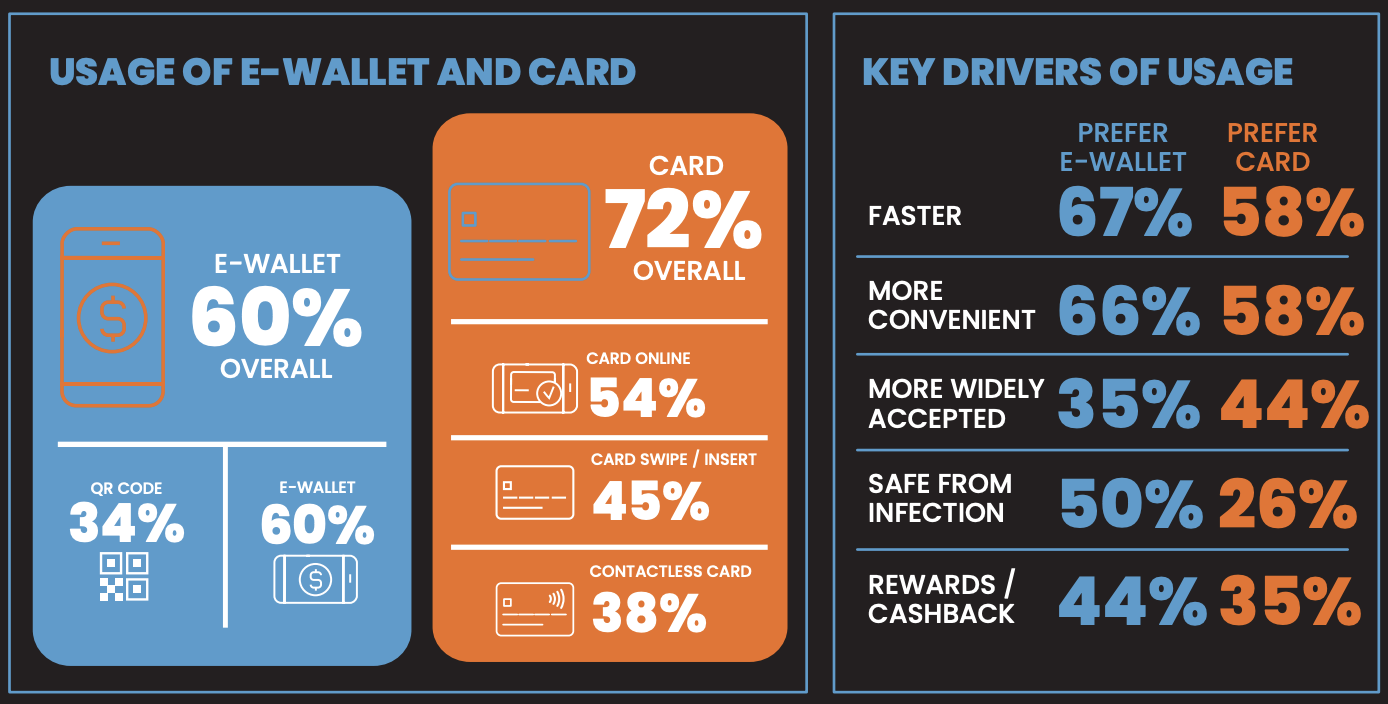

When it comes to e-wallets versus cards, consumers always look for speed and convenience as the key drivers.

While these two payment methods coexist right now, consumers’ preference for e-wallets may drive the payment method’s future growth and usage, especially if consumers perceive them as more widely accepted.

4. The Pandemic Has Given Rise to New Consumer Habits

Digital transformation from traditional business to online has created a new habit for consumers.

More and more consumers love shopping at big online marketplaces to grab amazing deals, especially during mega sales like 11.11.

We’ve also seen a rise in micro-businesses in local communities.

From homemade food, cookies, and snacks to beauty products, consumers shop from these local online businesses to support them during the pandemic.

5. eCommerce Is Growing in Southeast Asia

People prefer to spend more time at home than before, and the only choice for shopping from home is online through websites or apps.

The impact of the pandemic has significantly boosted online shopping.

With more time to research at home and look for the best online deals, consumers are becoming more aware of online promotions, helping them save as much money as possible.

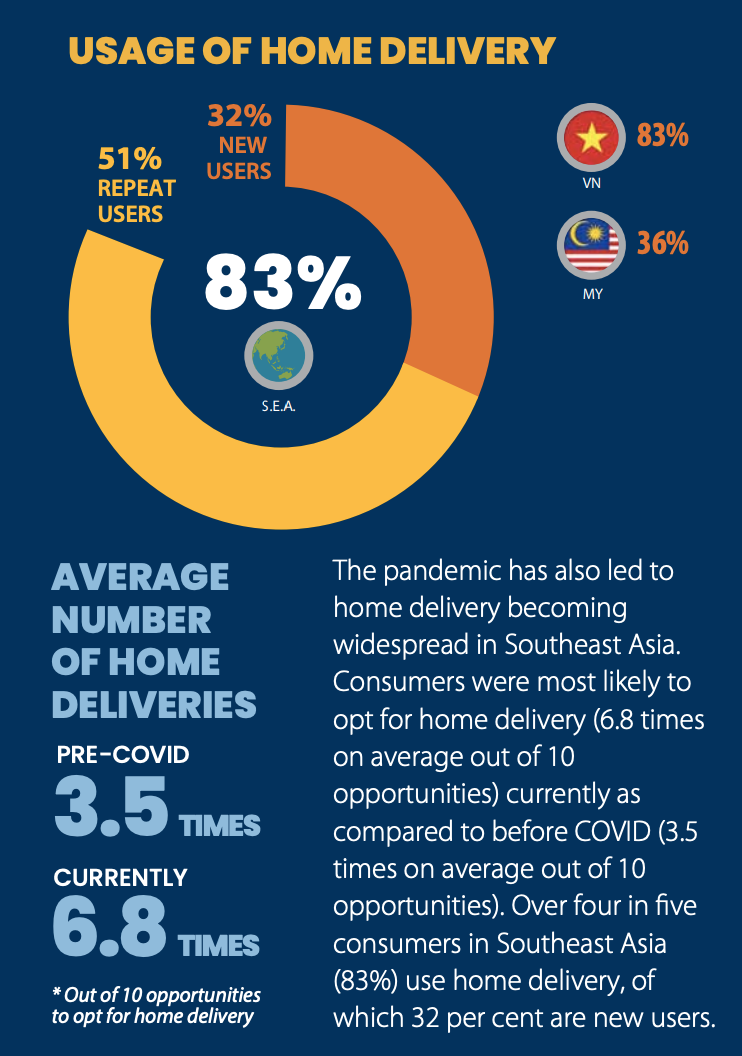

6. More Consumers Are Turning to Home Delivery

The number of Grab and FoodPanda delivery drivers has been increasing since the pandemic started in 2020.

Not only that, but many online home businesses also choose to deliver products to their consumers nearby.

This is a very good sign. Consumers are already used to paying online before delivery. It’s convenient and lowers the risk of contact.

Cash on delivery still makes up the majority of payments because it caters to different types of businesses.

This choice is understandable because new customers will want to make sure they receive the real products before paying.

7. Affected Categories Are Likely to See a Higher Spend Post-Pandemic

In Southeast Asia, the pandemic has also affected consumer spending, with consumers prioritising essential items, ranging from groceries and personal care items to home office equipment and small technology items that help them work better from home.

Southeast Asian consumers have also spent more on digital services such as content subscription services and gaming subscription services during the pandemic, likely due to more people staying home.

However, in the post-pandemic era, travel and dining activities will rise again. While there is still a long way to go, we hope the day comes soon.

8. Mobile Payments Have Been Driven By the Rise of Super Apps

The recent Tokopedia and Gojek merger created Indonesia’s largest digital services company.

Gojek is one of the most prominent super apps in Indonesia, offering access to several services from one single app.

Even AirAsia is on track to become the leading ASEAN super app, transforming its business direction.

There is still a long way to go to see more rising super apps in Malaysia.

9. Instalment Payments Have an Opportunity to Grow

The usual credit card instalment plans still exist, but new emerging fintech start-ups like PayLater from Grab, myIOU, hoolah, and Atome are gaining huge attention with their 0% interest rates.

The ability to split the total payment into multiple instalments with zero interest is good for both consumers and merchants, increasing conversion rates.

Let’s not forget that Square will purchase Afterpay for $29 billion in Australia’s biggest-ever buyout. Buy now pay later solutions are booming worldwide.

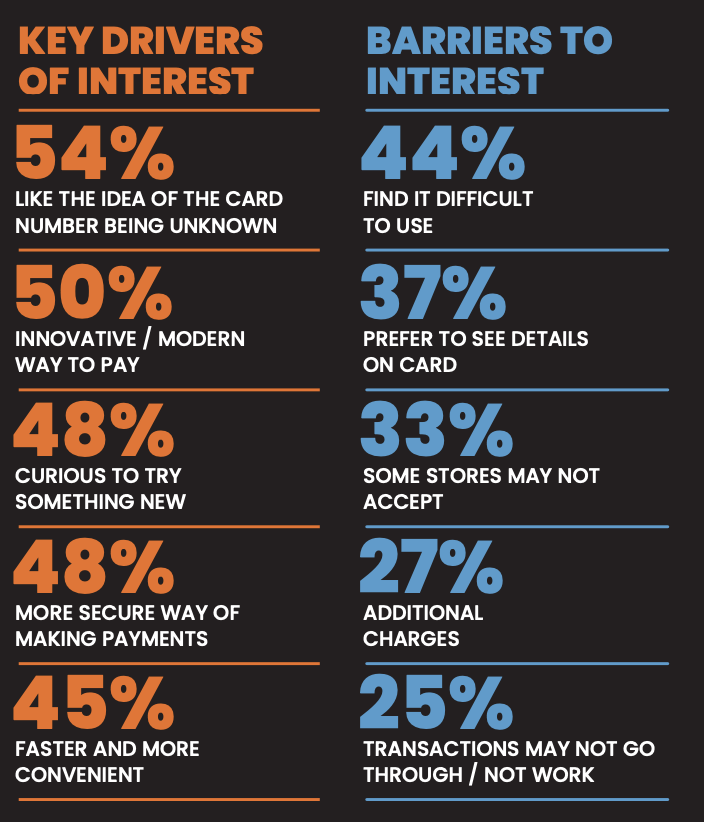

10. Numberless Cards Are a Safer Way to Pay

Numberless cards are a fairly new concept in Southeast Asia, with moderate awareness levels among consumers in the region (45%).

Currently, Grab Malaysia is expected to launch its numberless GrabPay card, but there is still no official launch for this type of card. The GrabPay card is currently available in Grab Singapore.

With so many cashless payment methods available in the market, consumers might switch to this card in future if the new method can provide better security, convenience, and more benefits than other payment methods.

11. Security and Rewards Drive Interest and Adoption

The incentives and rewards game is a long-term strategy implemented by all e-wallet providers, eCommerce marketplaces, and banks.

Free vouchers, coupons, and cashback programs directly affect consumers’ final purchase intent on the payment platform.

With a little bit of searching online, you can easily find and join various Facebook, Telegram, or WeChat groups for the latest online vouchers.

Frequent online shoppers are price sensitive and always actively on the lookout for ways to maximise their rewards.

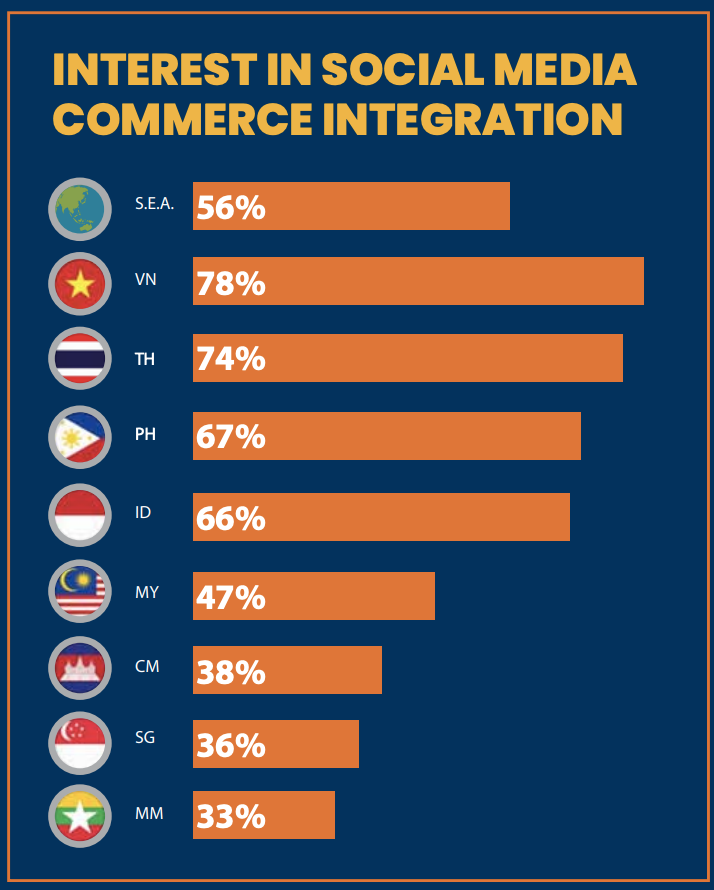

12. Integrating Commerce into Social Media

Integrating payment methods into social media is nothing new but limited to a few countries at the moment.

The experience of browsing products on social media and then completing payment within the same app is always welcome.

This seamless transaction process lowers the abandoned cart rate and increases sales.

Facebook has already launched its conversational commerce system, which integrates a payment system into its Messenger app.

Selling through a messaging app will soon become a reality.

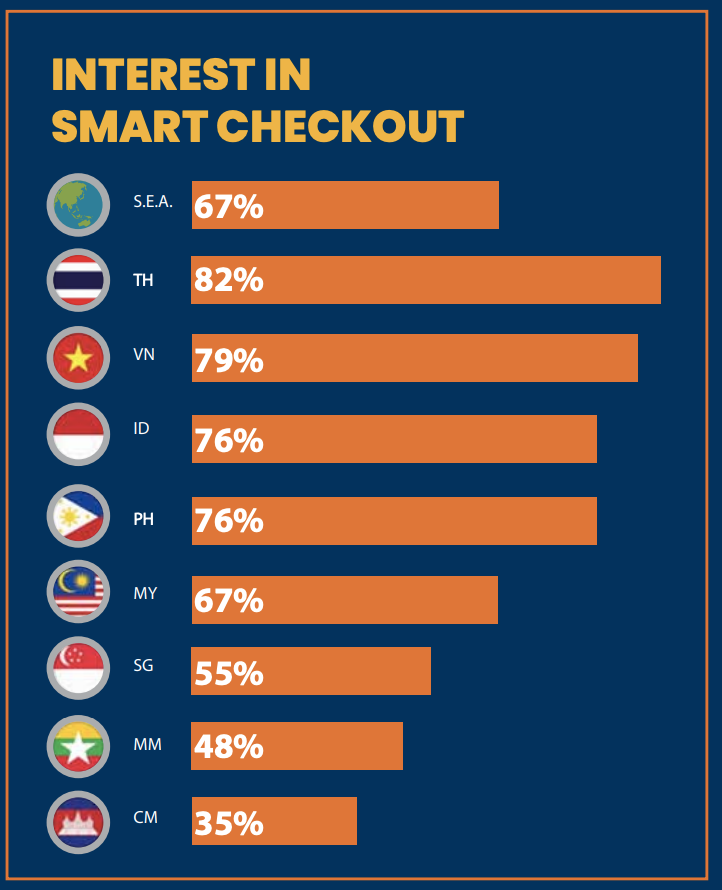

13. Smart Checkouts Are a Seamless Way to Shop

Smart checkouts are a relatively new experience in Southeast Asia, but many consumers are aware of this new way to shop.

Smart checkout allows consumers to easily add their purchases to a digital basket by scanning products with their mobile phones.

Consumers can easily pay for their purchases upon leaving a store without queueing at physical checkout counters, making shopping a seamless part of their everyday lives.

For example, Lotus’s (Tesco) has its Scan and Shop app, allowing customers to checkout without unloading their carts.

All they need to do is let the cashier count the total number of items, scan their phone for the total amount due, and pay right away.

Final Thoughts

While we look forward to recovering from the pandemic, we hope that this post provided valuable industry insights as we continue adapting to a digital-first world, powering lifestyles with intuitive, secure, and seamless eCommerce experiences in the Fourth Payment Revolution and beyond.

Check out the original report: Visa Consumer Payment Attitudes Study 2021: Powering the Acceleration of Digital-first Experiences